Introduction

In the digital age, technology has become an essential tool in simplifying various processes for both government and citizens. One such initiative is the Karnataka Government Insurance Department (KGID) portal, designed specifically to offer state employees a comprehensive insurance platform. If you are a government employee in Karnataka, understanding the nuances of this portal and how it works can help you access valuable benefits with ease. In this article, we’ll dive deep into the KGID login process, its objectives, and everything you need to know about accessing your insurance information online.

What is KGID?

KGID stands for the Karnataka Government Insurance Department, an organization that provides life insurance policies and other insurance services to government employees in Karnataka. The primary goal of KGID is to ensure that all employees under the state government umbrella are financially protected in case of unforeseen circumstances. This insurance scheme covers everything from life insurance, disability benefits, and maturity amounts, making it an essential part of the benefits package for Karnataka’s government employees.

The KGID portal is a digital platform introduced to streamline processes like policy application, payment of premiums, tracking of policy status, and applying for claims. By enabling users to manage their insurance details online, KGID aims to provide convenience and transparency to policyholders.

Read Also: Flipkart Seller login | Razorpay Login

About KGID Portal

The KGID login portal is designed to allow government employees of Karnataka to access their insurance details at any time and from any location. The portal provides a range of services including checking the status of your policy, payment of premiums, calculating maturity amounts, and applying for claims. The portal is user-friendly and built to ensure that government employees can easily navigate the insurance process.

Key Features of the KGID Portal:

- Policy Information: Policyholders can access detailed information about their insurance policies, including premium schedules and maturity dates.

- Premium Payments: The portal allows users to make their premium payments online, saving time and effort.

- Claim Management: Employees can apply for and track the status of their claims directly through the portal.

- Maturity Calculation: Users can calculate the maturity amount they are eligible to receive at the end of their policy term.

- Grievance Redressal: Policyholders can file complaints or raise concerns through the portal and track the progress of their resolution.

UUMS Login Portal Objectives

The KGID login system operates through the UUMS (Unified User Management System), which is a secure way for employees to access their insurance information. The key objectives of this KGID login system are:

- Enhanced Security: The UUMS ensures secure access to user information with a dedicated KGID number and mobile verification.

- Simplified Access: It simplifies the process of accessing the portal by allowing users to log in anytime and from any device.

- Centralized Management: The system centralizes all insurance-related activities, from applying for a new policy to tracking claims.

Read Also: MocDoc Login

What Types of Insurance Benefits Can You Avail?

As a policyholder under the KGID scheme, government employees can avail of several types of insurance benefits, which include:

- Life Insurance Coverage: This is the basic benefit offered by the KGID scheme. In the unfortunate event of a policyholder’s death, the nominee will receive a sum assured under the life insurance policy.

- Disability Insurance: If a policyholder becomes disabled due to an accident or illness, they can claim disability benefits under their KGID policy.

- Maturity Benefits: On the successful completion of the policy term, the policyholder will receive a lump sum amount as maturity benefit.

- Loan Against Policy: Employees can take loans against their policy in case of an urgent financial need.

- Accidental Death Benefit: Additional financial support is provided in case the policyholder dies due to an accident.

These benefits are designed to ensure the financial stability of government employees and their families, especially in times of need.

How Much is the KGID Maturity Amount?

The K.G.I.D maturity amount varies depending on several factors such as the duration of the policy, the premium amount, and the specific plan chosen by the policyholder. In general, the maturity amount is calculated based on the sum assured and any bonuses accumulated over the policy term.

How to check kgid balance for maturity amount, to determine the maturity amount, use the following formula:

- Maturity Amount = Sum Assured + Accumulated Bonuses

For example, if the sum assured is ₹5,00,000 and the policyholder has accumulated bonuses worth ₹1,50,000 over the policy term, the total maturity amount will be ₹6,50,000.

Who Can Use the KGID Portal?

The KGID portal is exclusively available to employees working under the Karnataka state government. This includes a wide range of government departments, ensuring that all state employees can benefit from the insurance services provided by the KGID.

What is Needed for KGID Login?

To access the KGID portal and log in, employees need the following:

a) KGID Number

The KGID number is a unique identification number assigned to every policyholder. It is mandatory to have this number when logging into the portal, as it serves as the primary identifier for the employee. If you do not know your KGID number, you can contact the HR department of your organization or check previous policy documents.

What About KGID Number?

The KGID number is crucial for accessing all insurance-related services on the portal. This number is generated when an employee first enrolls in the KGID scheme, and it remains constant throughout the policyholder’s career. Employees should make sure to keep this number safe for future reference, as it will be required for all KGID-related activities.

b) Mobile Number

A valid mobile number is necessary for verification purposes. When you log in to the KGID portal, a one-time password (OTP) will be sent to your registered mobile number. This ensures that only authorized users can access the portal.

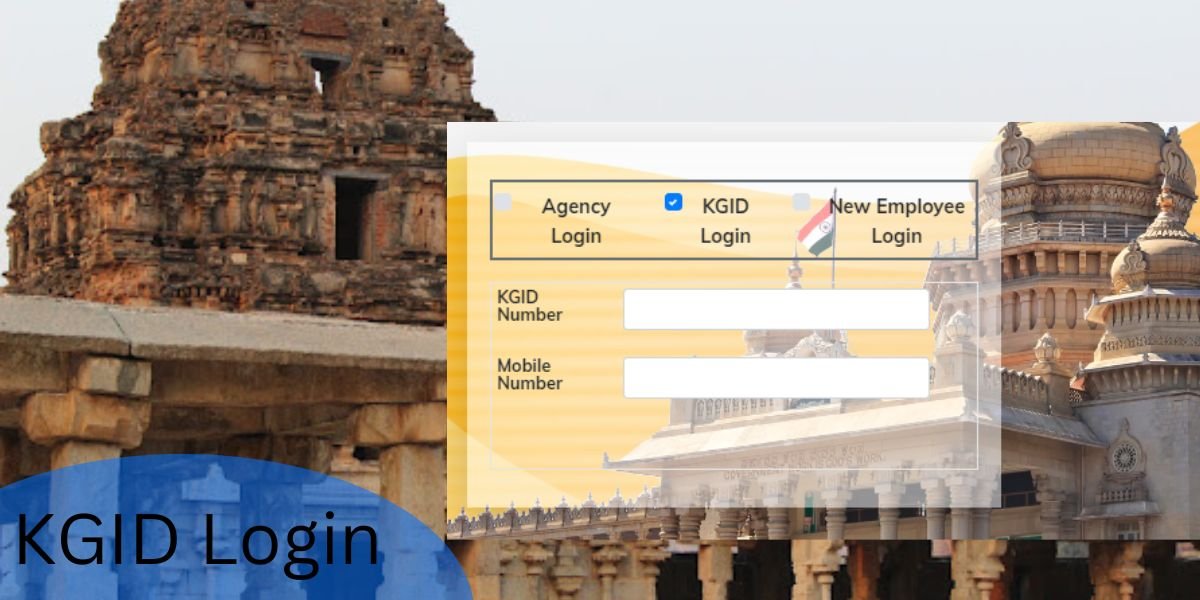

How to KGID Login on the Official Website?

The process of logging into the KGID portal is straightforward. Follow these steps:

- Visit the official KGID portal.

- Enter your KGID number in the designated field.

- Provide your registered mobile number.

- Enter the OTP sent to your mobile phone.

- Once verified, you will be logged into your account, where you can view your policy details, make payments, and access other services.

Importance of Karnataka Government Insurance Department

The Karnataka Government Insurance Department plays a vital role in securing the financial future of government employees. By providing life insurance and other related benefits, the KGID ensures that employees and their families are protected against life’s uncertainties. The KGID also offers easy access to these benefits through its online portal, which simplifies the entire insurance management process.

Key points highlighting the importance of KGID:

- Financial Protection: Offers life insurance and disability cover to protect employees and their families.

- Loan Facility: Employees can avail loans against their policies, providing a financial cushion during emergencies.

- Online Access: The portal ensures easy access to insurance information, premium payments, and claims.

About New Updates for KGID

The Karnataka Government Insurance Department continuously updates its policies and on KGID login portal features to enhance user experience. Some recent updates include:

- Enhanced Security Measures: With new two-factor authentication, the login process is more secure.

- Simplified Claim Processing: Improvements have been made to streamline the process of applying for and tracking claims.

- Automated Maturity Calculations: Policyholders can now calculate their maturity amounts instantly using an in-built calculator on the portal.

These updates ensure that policyholders have a seamless and secure experience when accessing their insurance details online.

FAQs

What is KGID?

KGID stands for Karnataka Government Insurance Department, offering insurance services to state employees.

Who can use the KGID portal?

The portal is exclusively for employees of the Karnataka state government.

How do I find my KGID number?

You can find your KGID number on policy documents or by contacting your HR department.

What is the maturity benefit in KGID?

The maturity benefit is the sum assured plus any bonuses accumulated over the policy term.

Can I make premium payments online?

Yes, the KGID portal allows users to pay premiums online.

What types of insurance can I avail through KGID?

KGID offers life insurance, disability cover, and accidental death benefits.

What if I forget my KGID number?

If you forget your KGID number, you can retrieve it by contacting the HR department or reviewing your policy documents.

Is the KGID portal secure?

Yes, the portal uses OTP verification and other security measures to ensure the safety of user data.

Conclusion

The Karnataka Government Insurance Department (KGID) has made significant strides in ensuring that state employees have access to comprehensive insurance services. The KGID portal simplifies managing policies, making premium payments, and tracking claims. With features like maturity amount calculation and secure login, the portal is a game-changer for government employees. If you are part of the Karnataka state workforce, logging into the KGID portal can help you manage your insurance policies more effectively, ensuring a secure financial future for you and your family.